top of page

검색

How JPMorgan Views MSTR: Its Structural Role in Collaboration with Wall Street and the Outlook Ahead

MSTR functions as a critical node in the emerging financial system where Bitcoin is being reframed as neutral collateral within the United States’ liquidity strategy. As stablecoins expand dollar liquidity on-chain, Bitcoin shifts from a speculative asset to financial infrastructure, and MSTR acts as the key pipeline connecting traditional capital markets to Bitcoin. This alignment explains why Wall Street manages rather than excludes MSTR.

Charles K

1월 9일4분 분량

The Yuan Falls Below 7 per Dollar: What Is China Really Trying to Achieve?

China’s yuan moving below 7 is not about exports or short-term stimulus. It signals a strategic shift to attract global capital, fund AI and big tech, lift asset prices, and rebuild consumption—aiming to reduce U.S. financial dominance.

Charles K

1월 2일4분 분량

MSTR and the Liquidity Counterattack: Where Are Bitcoin and Ethereum Headed in January 2026?

SLR easing unlocks bank capital, fueling the repo market. The basis trade amplifies this liquidity. As Treasuries saturate, capital migrates to crypto—the ultimate beneficiary of restored leverage.

Charles K

2025년 12월 26일4분 분량

Why Investors Should Not Abandon the Korean Stock Market

Korea’s real estate–centered asset model has reached its limits, creating social costs and blocking long-term wealth formation. As institutions and governance shift, the stock market becomes the only viable place to store time. Abandoning Korean equities now risks missing a decade of structural transition.

Charles K

2025년 12월 24일4분 분량

Korea’s Strategic Role in the Data-Over-Oil Era

Throughout history, hegemony has always been determined by who controls the core resource of the era. In the age of industrialization, that resource was oil. Oil powered factories, factories produced goods, and goods created wealth. Nations went to war to secure energy, and the global order was reorganized around the flow of oil. Today, that order is quietly—but unmistakably—changing. A resource more important than oil has emerged. That resource is data. Data is not merely a

Charles K

2025년 12월 19일4분 분량

Why Ray Dalio and Trump See Subsidies and Investment as a Strategy, Not a Risk

Ray Dalio has recently gone beyond merely aligning with Trump’s policy direction; he appears, in effect, to be participating in the construction of that vision. This is not simply a political choice. It becomes understandable once we grasp where the United States is ultimately heading. The area on which the U.S. is now staking its future is AI. It sees artificial intelligence as the core instrument for maintaining global dominance and is prepared to deploy resources on an unp

Charles K

2025년 12월 18일4분 분량

December FOMC Review: Where Is the Market Headed Next?

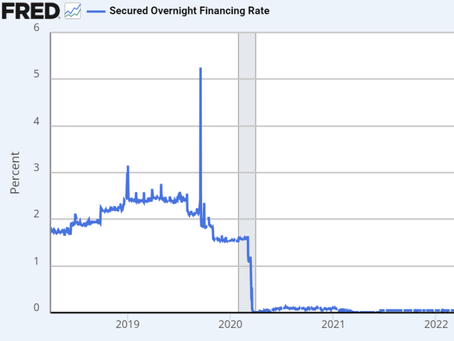

The Federal Reserve’s latest move was outwardly framed as a response to “slowing employment,” but its true purpose was unmistakable: to relieve pressure in the short-term funding market and stabilize the financial system’s core. As bank reserves fell below $3 trillion , repo rates spiked and the Standing Repo Facility (SRF) saw surging usage. The Fed could no longer stand by. The result was clear: the end of quantitative tightening (QT), a temporary $40 billion “lite QE,” an

Charles K

2025년 12월 11일3분 분량

The so-called “collapse of European civilization” mentioned by the United States is, in fact, about defending the dollar’s hegemony.

The U.S. National Security Strategy (NSS) appears on the surface to deliver a cultural rebuke, accusing Europe of facing “civilizational erasure.” Yet the essence of that statement is neither cultural nor moral; it is financial. The report’s real subject is credit and currency. In effect, Washington is saying this: if Europe can no longer sustain itself through growth, its system becomes a threat to the credibility of the U.S. dollar. Within the dollar-based order, the euro i

Charles K

2025년 12월 8일4분 분량

Reasons to Be Positive About Investing in Ethereum and BitMine

Ethereum is not just another cryptocurrency. It is a platform capable of redesigning the foundation of tomorrow’s financial system and becoming the core infrastructure of the digital era. If Bitcoin is “digital gold,” then Ethereum is the digital financial platform . In other words, it is not simply a place where money is stored—it is a network where money moves, contracts execute, and investments operate programmatically. And as autonomous AI agents emerge, the importance of

Charles K

2025년 12월 5일6분 분량

Main Street vs. Wall Street: The Bubble Hasn’t Even Started Yet

The current market decline may appear, on the surface, to be caused by the spike in short-term rates, SOFR volatility, and the unwinding of basis trades. But the real trigger is far more structural. It began when cash accumulated in the TGA account. As government cash climbed toward the $1 trillion level, bank reserves quickly fell below $3 trillion, draining liquidity out of the system. This drop directly tightened conditions in the short-term funding markets. Meanwhile the

Charles K

2025년 11월 21일4분 분량

Why Bitcoin and Ethereum Crashed?

To Understand What’s Happening, You Must First Understand the U.S. Financial System. The recent crash in Bitcoin and Ethereum cannot be explained by sentiment alone. To truly understand what’s happening, you have to understand the mechanics of the U.S. financial system—especially the relationship between the Treasury market and the repo market. Modern finance revolves around U.S. Treasuries. They function as a substitute for deposits, the backbone of dollar liquidity, and the

Charles K

2025년 11월 17일5분 분량

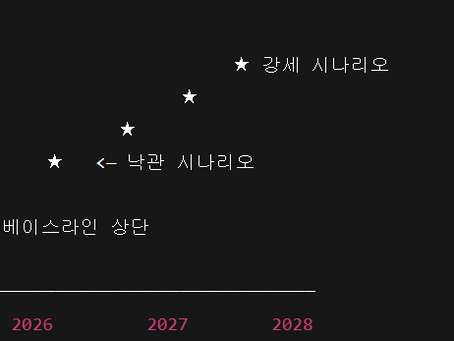

America’s Structural Direction in 2028: Ethereum Is Not a Choice, but a Necessity (With Price Outlook)

The world today faces a scale of capital demand that the existing financial system can no longer resolve. AI infrastructure, semiconductors, energy, defense, and digital transformation all require investment at the level of nation-states, and the numbers involved already exceed what corporations or banks can handle. The United States is no exception. To maintain technological hegemony, the country must pour in billions—trillions—over and over again. But fiscal capacity alone

Charles K

2025년 11월 15일4분 분량

The Rise of the AI Bubble Theory, What Is Driving Market Expectations for a Year-End Rally?

The world has entered the era of the Big Government . In the past, during the age of small government, the market drove innovation while the government remained a regulator. Today, the roles have reversed. Governments now set the direction of industries, and capital naturally follows. We are living in what can rightly be called the era of state capitalism . In this environment, nations no longer trust the “invisible hand.” Strategic sectors such as artificial intelligence, se

Charles K

2025년 11월 12일4분 분량

OpenAI’s Government Guarantee? Let’s Think About the Hidden Meaning.

Power in the 21st century is shifting in ways that are almost invisible. In the past, the state stood at the center of authority — it made laws, collected taxes, monopolized military force, and controlled the lives of its citizens. But today, that role is increasingly being assumed by corporations. Giants such as Google, Microsoft, Meta, OpenAI, and Alibaba are no longer mere private companies. They already manage the world’s information and data, and they influence people’s

Charles K

2025년 11월 8일5분 분량

After China’s Fourth Plenum and the U.S.–China Summit at APEC: Where Is Investment Headed?

The Fourth Plenary Session of the 20th Central Committee , which began on October 20, became a decisive moment for Xi Jinping’s leadership. Contrary to outside speculation about succession, Xi instead put forward long-term goals: the 15th Five-Year Plan (2026–2030) and the ambition to elevate China to a “moderately advanced” nation by 2035. In doing so, he signaled his intent for a de facto fourth term, showing determination to personally see these projects through. Yet the r

Charles K

2025년 10월 25일4분 분량

Gold price crash? Market sentiment is shifting toward Ethereum and U.S. equities.

Recently, gold prices have plunged. The flagship gold ETF, SPDR Gold Shares (GLD) , fell more than 6%, while gold miner ETFs such as VanEck Gold Miners (GDX) dropped nearly 10%. It was the steepest decline in 12 years, and the sudden shock to one of the world’s most trusted safe havens has left markets unsettled. This decline has sparked two contrasting interpretations. The first is pessimistic: that the coming crisis may be so severe that even gold cannot serve as a reliabl

Charles K

2025년 10월 22일4분 분량

If U.S. regional bank distress is driven by the shutdown, there is no reason to stop investing.

The recent headlines about regional banks facing distress and even potential failures have made the stock market appear suspicious. But if we step back and analyze the U.S. financial system more carefully, the real anomaly is not just the equity volatility but rather the sharp increase in the Treasury General Account (TGA) and the resulting decline in bank reserves. The TGA functions like the Treasury’s bank account: tax revenues and bond issuance flow in, while government s

Charles K

2025년 10월 17일3분 분량

K3-LAB: Investment Philosophy and Mission

Beneath the surface of the global financial markets lies a force not always visible, yet immensely powerful: the Family Office (FO) . These exclusive wealth management entities, built for ultra–high-net-worth families, take two primary forms. The Single Family Office (SFO) serves only one family, while the Multi Family Office (MFO) spans several. According to Deloitte, the number of FOs has surged by more than 30% since 2019, surpassing 8,000 worldwide, and is expected to r

Charles K

2025년 10월 17일3분 분량

JPMorgan’s Bet on Quantum and AI Aligns with America’s Strategic Path

Today, JPMorgan stated, “It has become painfully clear that the U.S. has relied too heavily on unreliable suppliers for critical minerals and products essential to national security. We must act now,” directly addressing China’s rare earth export restrictions. This is not merely about supply chain risk management. It signals that even global financial capital is now aligning itself with the logic of nationalistic capital allocation . The era where the state, finance, and cor

Charles K

2025년 10월 14일3분 분량

China’s Rare Earth Controls and the U.S. 100% Tariffs: Will Trump’s TACO Emerge?

The current escalation in the U.S.–China tariff conflict is not a random shock. Its roots go back to April, when Washington imposed port...

Charles K

2025년 10월 11일3분 분량

bottom of page